Customizable Words. Huntington Bank provides customized loan terms and conditions which are customized in order to fit personal financial facts, allowing borrowers discover an installment bundle that fits the funds.

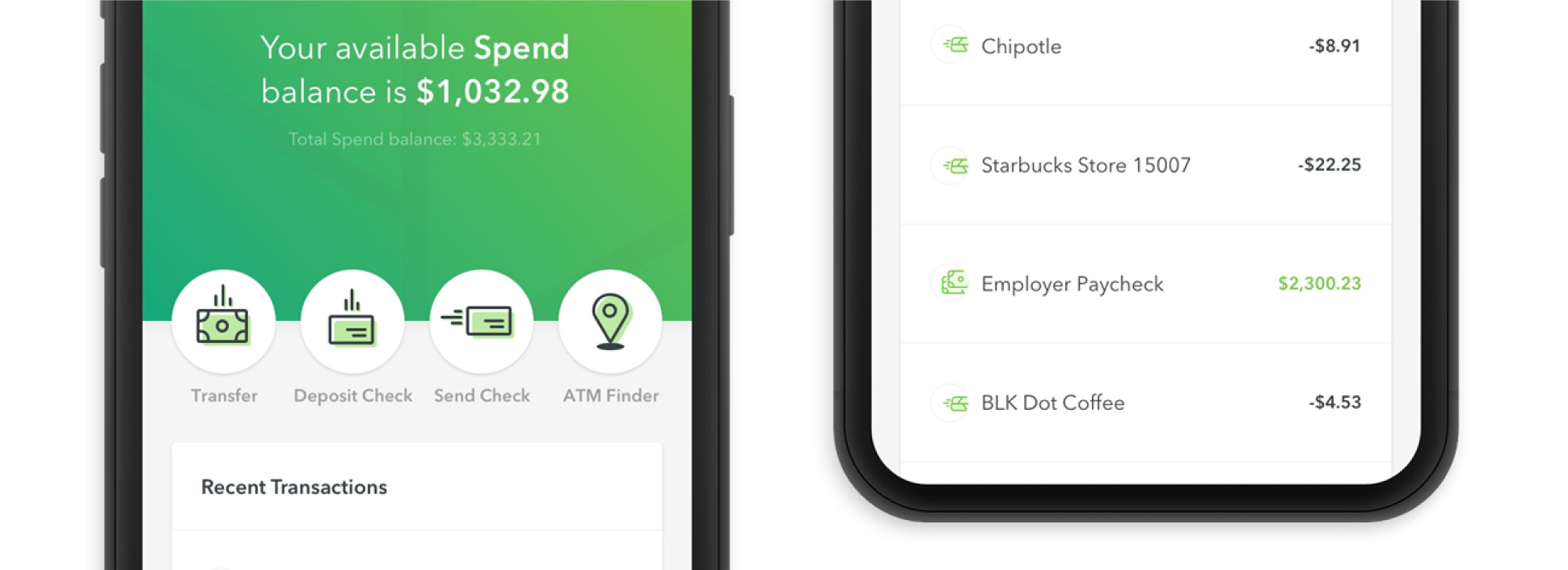

On the internet Account Government. Consumers can also be conveniently create its personal bank loan levels online, helping these to check balance, track transactions, to make repayments effortlessly.

Fast access to help you Finance. Huntington Bank has the benefit of quick access to help you loans, allowing individuals to get their money timely and use it to own their meant aim.

Qualification Criteria. Like most lender, Huntington Financial enjoys certain eligibility conditions private fund, and never all of the candidates ount otherwise conditions.

Collateral Criteria. Secured personal loans regarding Huntington Lender want guarantee, installment loans online Kingston Minnesota definition consumers have to hope assets as the security. This may not be feasible for folk and can even restriction borrowing from the bank choice.

Creditworthiness Factors. Creditworthiness performs a critical role from inside the loan recognition and you may rates. Those with smaller-than-perfect credit histories could possibly get deal with pressures in the protecting positive loan terms or possibly given highest interest rates.

Restricted Accessibility. Huntington Bank’s unsecured loans are merely obtainable in 11 claims in which the financial institution currently has actually a presence: Kansas, Illinois, Indiana, Kentucky, Michigan, Pennsylvania, West Virginia, Wisconsin, Minnesota, Southern Dakota, and Colorado. So it limited availableness could possibly get maximum availableness having prospective individuals residing exterior this type of claims.

To be certain a smooth app processes having a consumer loan, it is best to consider the required documents ahead. You are able to contact brand new credit cardiovascular system during the +step 1 (800) 628-7076 otherwise reach out to your neighborhood branch to have personalized suggestions into certain papers needed for the application.

Requirements

- Social Shelter otherwise Taxpayer Identification Matter. So it identification is very important for confirming the label and you will complying which have regulating conditions.

- Private personality. Valid identification data, eg a license or passport, could be necessary to introduce your own name.

- Money suggestions. Documents highlighting your earnings, such as shell out stubs, taxation statements, or lender statements, will be required to evaluate your financial power to pay-off new mortgage.

- A career record. Specifics of your a job records, including your employer’s title, work condition, and you can lifetime of a job, are typically questioned to check your own balance and you will capacity to meet cost debt.

A method to Get the Currency

After Huntington Lender approves yours application for the loan, the bank have a tendency to normally disburse the mortgage add up to your because of a way of your decision. Here are the common tips Huntington Financial ount.

Head Put. Huntington Bank is transfer the borrowed funds funds directly into your designated family savings. This process offers convenience and you may enables immediate access on money.

Have a look at. The bank ount, which can be shipped to your entered target. Then you can put otherwise bucks the new see depending on the preference.

Transfer to Huntington Bank account. When you yourself have an existing Huntington Savings account, the mortgage money is transferred directly into one membership.

How to Repay a beneficial Huntington Lender Consumer loan?

As soon as your personal loan application is accepted, you are granted a lump sum. Then, you are going to pay-off the loan over a selected months owing to consistent repaired costs and you will a fixed interest.

Points to consider

- Financing Words. Huntington Lender gives the freedom of around three- otherwise five-seasons conditions for their signature loans, allowing individuals to determine the fees several months that suits their requirements.

- Charges. Gain benefit from the benefit of zero application otherwise prepayment costs when getting an unsecured loan off Huntington Financial. Which guarantees a transparent borrowing from the bank experience without the a lot more charges.

- Restricted Supply. It’s important to note that Huntington Bank’s signature loans are presently only available when you look at the 11 states where the financial has actually an exposure: Kansas, Illinois, Indiana, Kentucky, Michigan, Pennsylvania, Western Virginia, Wisconsin, Minnesota, Southern area Dakota, and you can Colorado. Which geographic limit get limit access for those living outside such says.