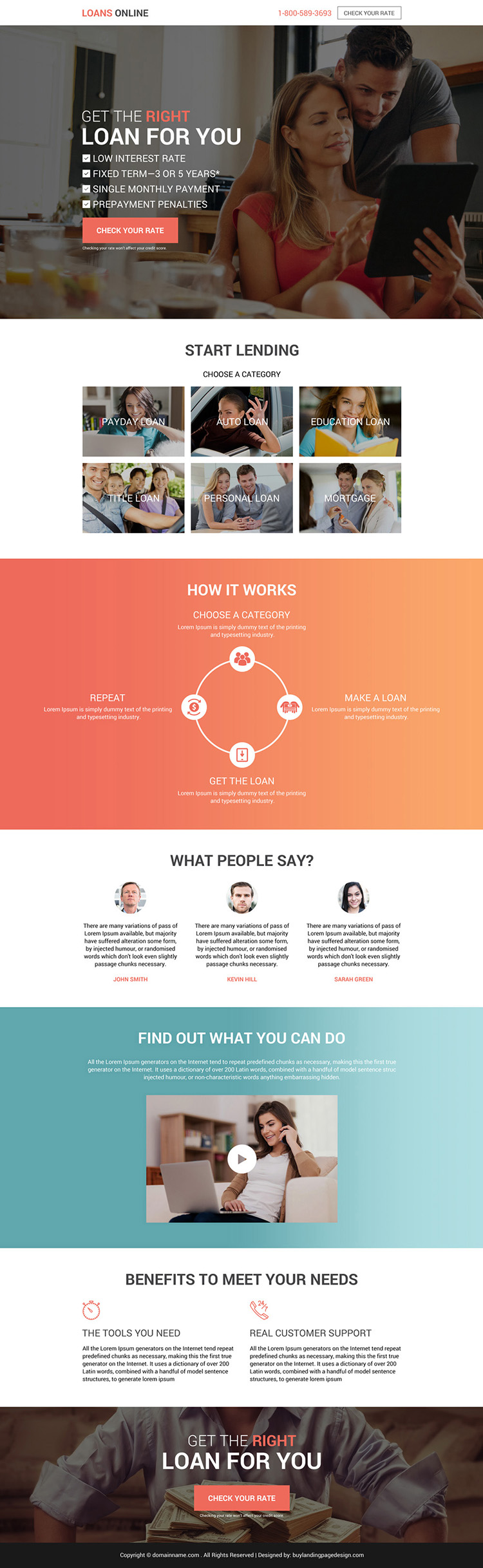

- Loans can be paid off for the 3 to 5 years.

- No repayment punishment.

- Powerful cellular app makes it possible for with the-the-go handling of your loan.

- Borrowing Fitness Unit can assist in accordance debt lifestyle to the track.

- Origination percentage out-of ranging from dos.8% and you may 8%.

- Later percentage fees regarding $10.

- No reduced prices for autopay.

Property security loan, that’s directly pertaining to household guarantee personal line of credit (HELOC), https://paydayloancolorado.net/salt-creek/ are a loan taken out contrary to the guarantee you really have during the your home.

The new equity ‘s the difference in that which you enjoys repaid and you can everything you still are obligated to pay. Such as, whether your residence is appraised within $three hundred,000 and you also owe $100,000, the guarantee are $two hundred,000. That matter is exactly what a lender use to provide your with a certain dollar number when you look at the that loan otherwise collection of borrowing. Your property guarantee financing was secure by the family.

A house improve financing is a personal loan. It generally does not make use of the fresh equity of your property otherwise use your residence because the security in the event that you cannot spend the loan straight back. It indicates the lender takes on a high risk inside delivering the borrowed funds for your requirements, and for that reason, you could potentially select higher rates of interest much less positive terms and conditions.

However, it is a very important choice if you are searching to possess a little amount of money, such as for example up to $10,000 to solve that leaking rooftop, or if you would like to get your hands on the cash having an immediate fix, such as for instance fixing new sewer system.

Simple tips to Compare with Find the best Financing

The latest Annual percentage rate, otherwise Apr, is the rate of interest you may spend along the lifetime of the borrowed funds. Quite often, the better your credit score and you may credit rating, the lower your Annual percentage rate might be.

There could be a base Apr, instance cuatro.99%, that is set aside just for a knowledgeable borrowing-owners or individuals who commit to financing having a particular count that must be repaid inside a smaller time.

Origination charges

Certain lenders wanted an enthusiastic origination payment. So it fee is actually used right at the start of the mortgage, or perhaps in some cases, you could potentially will spend it alone, up-front side.

So it commission is oftentimes applied to improve financial recover the will set you back within the documents, big date, or other costs they incur in providing the borrowed funds.

Come across a loan provider that will not wanted an enthusiastic origination fee, as these is come across thousands of dollars, depending upon how big is a loan.

Great features

Most other special features include a robust app that is mobile approaching your loan at any place, the option to help you refinance, the ability to replace your fee payment dates, or even the capability to bring in good co-signer to possess a high amount borrowed, if necessary.

Cost period and you can conditions

The majority of it may rely upon just how much the borrowed funds are for; its unlikely financing off $5,000 may come which have a 10-year fees bundle.

Glance at the money called for four weeks to dictate just what fees period you might easily manage. Plus, glance at the small print: could there be a penalty to own paying off the loan early?

Resource Day

If you are think in advance, this may never be an issue. For example, while taking out fully that loan for that restroom repair that’s arranged for many months from today, then exactly how in the future you can buy the cash may not number as frequently.

But when you features a leaky rooftop and it’s the latest height from spring storm 12 months, you might need that cash immediately. Particular organizations bring a funding duration of not absolutely all months off acceptance of your own loan, while some might take a couple weeks.