Citizen equity increased of the more nine% regarding very first one-fourth away from 2023 from the basic one-fourth out of 2024, predicated on CoreLogic’s Citizen Equity Facts. An average number of resident collateral are higher than $300,000.

Since property cost vaulted, many People in the us wanted family guarantee money, because of the a procedure that pertains to taking out financing-usually at less interest than many other forms of borrowing-which is shielded by the family just like the collateral. However, there are some positive points to family collateral funds, like taxation deductions less than particular conditions, nevertheless they incorporate risks. In the event that a homeowner defaults on the mortgage, it run the risk out of shedding their house entirely.

To stop the risk noticed in this new 2008 overall economy, and this requisite people to keep up little to no security within house, lenders wanted individuals to steadfastly keep up good 20% share. Generally, loans was granted so you’re able to property owners which have sensible borrowing as well as 2 many years out of income records, certainly other criteria.

In many cases, some one have fun with domestic equity finance for renovations, instance building work a home or restroom. Other well-known ways somebody have fun with their house collateral mortgage was getting combining loans and you may advancing years income.

Secret Takeaways

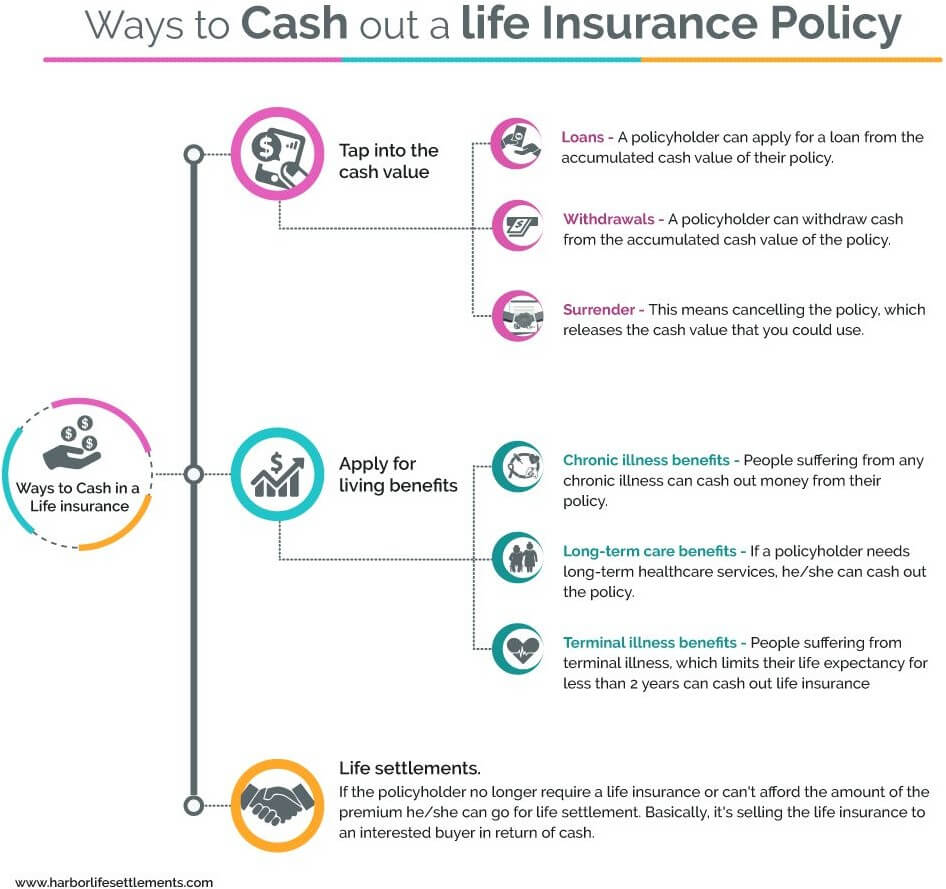

- Household collateral money ensure it is property owners to take out a loan playing with their property as the equity. Different types of domestic collateral loans is refinancing, 2nd mortgages, and you will domestic guarantee lines of credit (HELOC).

- The worth of You.S. home guarantee is higher than $3 hundred,000 as of the original quarter out of 2024.

- Considering good LendingTree study of 416,000 family equity financing concerns away from profiles of the LendingTree online mortgage marketplaces, many aren’t quoted purposes for the cash were home improvements, debt consolidation reduction, non-home-improve purposes, later years money, and other intentions.

That have investigation away from a LendingTree study of 416,000 home guarantee mortgage https://paydayloancolorado.net/morgan-heights/ issues out of profiles of the LendingTree on the web loan , here you will find the main reasons, in addition to the finest towns, each.

Home improvements

Across the % of those looking to property collateral loan, renovations was in fact the primary reason. In addition, it had been the absolute most cited reason around the most of the 50 states. One of those areas, Mississippi and you can Maine had the high offers off members.

- No. 1: Mississippi (%)

- Zero. 2: Maine (%)

- No. 3: West Virginia (%)

When you look at the You.S. tax password, the interest towards a home guarantee mortgage employed for renovations are income tax-allowable interest in the event the full financial financial obligation was $750,000 otherwise shorter to have finance taken out to your , and soon after. To own financing taken out in advance of upcoming, new restrict try $1 million. The inner Funds Services (IRS) states that mortgage should get, build or dramatically increase the home.

Debt consolidating

Debt consolidation is actually the following-most commonly quoted reasoning, bookkeeping getting % out of people. As previously mentioned earlier, household security financing often promote interest rates which might be quicker difficult than many other credit models including handmade cards.

Wyoming had the higher share off residents citing debt consolidation because one of the reasons (during the 29.8%), with Idaho and you can Southern Dakota.

- Zero. 1: Wyoming (%)

- Zero. 2: Idaho (%)

- Zero. 3: South Dakota (%)

Though getting out of debt try an intelligent monetary objective, it is important to consider advantages and you can downsides out-of taking out property equity financing to do so. Just like the family security money is actually secured, you are in danger regarding dropping your home in the event the anything simply take a switch into the bad-a high price to pay for repaying other forms of personal debt.

Non-Home-Update Resource Aim

Across the eight.68% off homeowners, non-home-update aim was indeed an element of the use. Investing in a company or investing the stock market ong says is actually Utah on % out of homeowners.