Receive a grant money

Many lenders won’t think it over money, there are many that will deal with money you receive out-of a great scholarship. With regards to the particular grant, capable give you to thousands of dollars during the income each semester out-of data, that could help increase likelihood of approval which have a loan provider.

- Fellowships;

- University grants; and you can

- Commonwealth grants

Other sorts of grants is actually unrealistic to get approved, including HECS exemptions, commission exemptions, a lot more allowances, lead payments off university fees etcetera. To help you effortlessly get a mortgage lower than a scholarship, you’d need to keep the next planned:

- You’d need a page out of your school confirming your own scholarship to help you upload to the financial;

- You need to indicate just how long are remaining in your scholarship – having no less than 12 months left is very effective

Because most of loan providers would not undertake head applications to have scholarship receiver, you may be most readily useful served by browsing a large financial company who will support you in finding a suitable you to compliment of its system. You’ll be able to boost your chances of approval insurance firms yet another income load towards software.

Loan providers measure the home income trying to get that loan, this is exactly why it’s essentially convenient for a few individuals to help you become acknowledged in the place of one. While you are nevertheless from the college or university or TAFE, but have somebody or shared candidate making a constant full-money, following a loan provider can be prone to offer the go-to come. The same is applicable if you have a living your self, whether or not that’s a part-hustle, part-time work or a small business you own.

A new idea is always to stick to the same work just before your apply since the majority loan providers will require you to feel the same boss for around half a year, and you can extended when you find yourself inside the a laid-back part, Ms Osti told you.

Wade attention-just

Interest-only (IO) lenders tend to have straight down initially costs than just dominating and notice (P&I) lenders, as for a period (1-5 years fundamentally) you only have to pay the attention component of the mortgage, not the main lent, definition your repayments are rather less.

Along the lifetime of the mortgage, yet not, your desire statement are higher than if you would repaid P&I for the entire financing several months. It’s also possible to need a bigger put.

Interest-just home loans

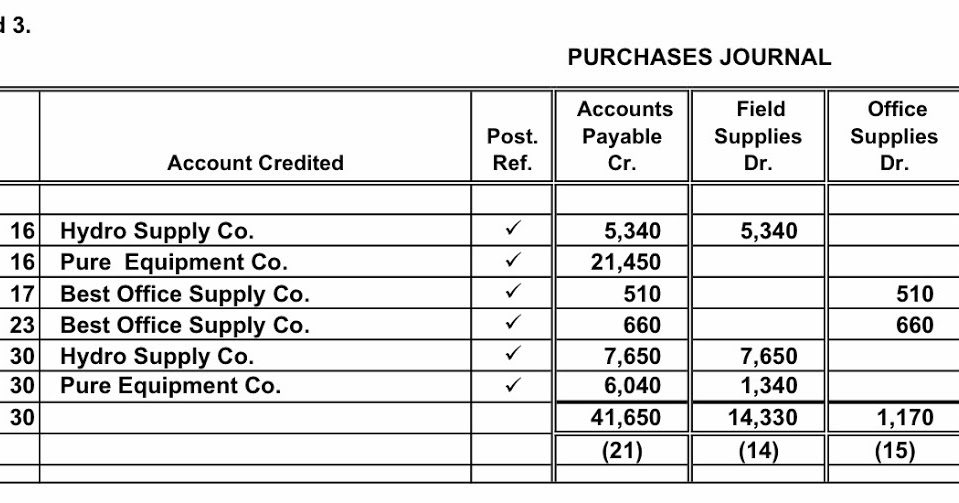

Purchasing a property otherwise trying refinance? The desk below have lenders with some of the low rates of interest in the market to have manager-occupiers looking to shell out attract-simply.

Feet conditions out-of: an effective $400,000 amount borrowed, variable, fixed, principal and interest (P&I) & desire just (IO) mortgage brokers that have an LVR (loan-to-value) proportion with a minimum of 80%. Yet not, the fresh new Examine Family Loans’ dining table makes it possible for computations to-be produced on the https://paydayloancolorado.net/fort-lupton/ details as the picked and enter in by the user. Specific things will be designated since the marketed, featured otherwise paid and may come prominently in the tables no matter of their services. The factors commonly checklist the brand new LVR into product and rate which happen to be demonstrably blogged toward equipment provider’s site. Month-to-month money, while the legs requirements is actually changed by the member, depends on picked products’ reported pricing and you will calculated of the amount borrowed, fees sort of, financing label and you can LVR due to the fact enter in by the representative/you. *This new Review speed lies in an effective $150,000 financing over twenty five years. Warning: this analysis rate is valid just for this case and might not tend to be all fees and you can charge. Different terms and conditions, fees or other financing numbers can result inside the a special investigations rate. Pricing right by . Consider disclaimer.