Keeping tabs on your own CIBIL score is a straightforward yet strengthening practice which enables you to take control of your monetary fitness. On a regular basis keeping track of their get supplies one to detect and rectify people inaccuracies, ensuring that your own borrowing from the bank profile stays inside an excellent position.

step 1. Go to a reputable Borrowing Bureau’s Webpages: Pick an established borrowing bureau’s webpages. Trusted credit reporting agencies into the India is CIBIL, Equifax and you can Experian.

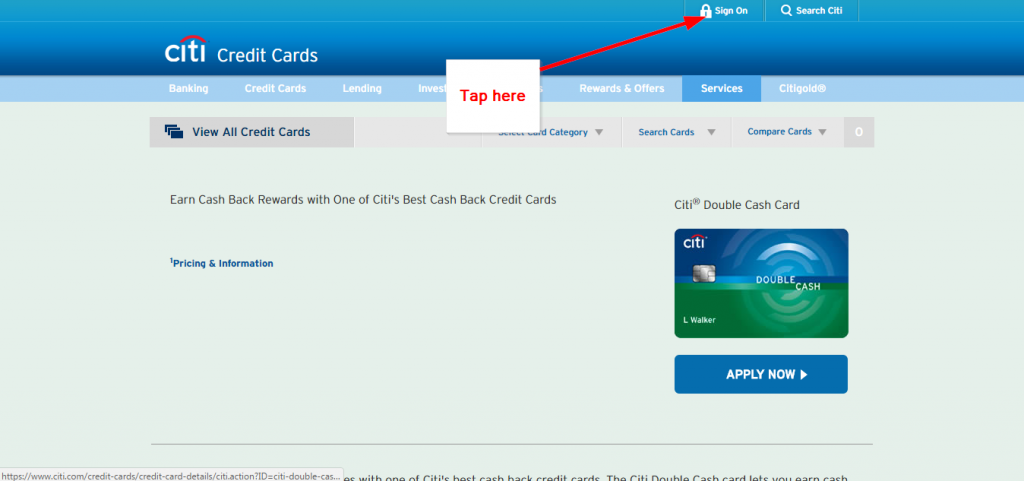

2. Navigate to the Credit rating Have a look at Area: Once toward chose borrowing bureau’s site, to get the brand new section seriously interested in checking your credit score. It may be branded because the Look at the Score’ or something like that equivalent.

How exactly to Consider CIBIL Score On the internet

step three. Deliver the Expected Private information to have Confirmation: To gain access to your credit score, you ought to bring information that is personal getting verification. Which usually includes details just like your label, go out out of beginning, Long lasting Membership Number (PAN) and contact advice.

4. Receive Your credit rating and you will Credit history Immediately: Shortly after effectively guaranteeing your own identity, you’ll discover your credit rating and credit report immediately. The financing declaration brings a comprehensive article on your credit score, and additionally specifics of the borrowing from the bank profile, fees background and you can people a great loans otherwise expense.

By following such actions faithfully, you can access the CIBIL get and you will credit history quickly, empowering one make informed economic conclusion.

If for example the CIBIL rating falls lacking the mandatory tolerance, you’ll find effective strategies you could pertain to alter your creditworthiness throughout the years. Here is a far more in depth exploration of them steps:

step 1. Prompt Expenses Costs: Be sure to pay-all your own expense promptly, without exceptions. Including credit card debt, financing EMIs, power bills or other economic commitments. Late or overlooked money can harm your credit rating.

dos. Remove A fantastic Debt: Functions vigilantly to attenuate your own an excellent debt, particularly revolving borrowing from the bank http://cashadvancecompass.com/payday-loans-ia/kingston for example bank card stability. Aim to manage a credit utilisation proportion (this new percentage of your borrowing limit utilized) out-of less than 31%. High mastercard balance relative to their credit limit is adversely affect your own get.

3. Display screen Credit Utilisation: Your borrowing utilisation ratio is critical. Take care of a wholesome proportion only using a fraction of your offered borrowing limit. Stop maxing away playing cards because can be rule financial stress to financial institutions.

4. Broaden Your Credit: A combination of borrowing from the bank models can be positively perception your credit score. Next to credit cards, thought diversifying along with other borrowing products, including personal loans or merchandising account. Be sure to create such account sensibly.

5. Avoid Numerous Loan applications: For every single loan application leads to a hard inquiry’ on your credit report, that temporarily reduce your rating. Reduce level of loan requests you make and you can lookup financial establishments before you apply. Applying for numerous money likewise can raise issues about debt balances.

Because of the applying such in depth methods, you could potentially work methodically towards the enhancing your CIBIL rating over the years. This, subsequently, improves the qualifications and you can terminology when applying for a mortgage and other variety of credit.

Completion

Protecting home financing are an excellent monumental action into the homeownership. Now that you understand Necessary CIBIL Score to own a home Financing, be mindful you to definitely a great CIBIL score opens gates to that options while helping you save cash in tomorrow. Continuously monitoring the get, improving it if required and maintaining in charge economic behavior are fundamental in order to reaching their homeownership desires.

Trust the financial institution you decide on, instance ICICI Lender, to support your journey to your ideal domestic. With ICICI Bank Home loan solutions, homeownership gets a tangible fact. Your ideal family awaits and ICICI Lender is here and also make they a real possibility.