W ith homes pricing supposed ever before high and you can inhabited elements as significantly more packed, more about customers is bending on building this new construction property into empty qualities. However, to shop for property and you can building another home nevertheless is sold with considerable costs-have a tendency to, the cost is similar to that of an existing domestic. Therefore, the majority of people which purchase home will need to search through financial choices, just like with the acquisition of a preexisting family. The process and click this link now needs are mostly the same as bringing home financing to have a property, together with a few unique requirements to own house.

To own informational intentions merely. Usually talk to an authorized mortgage or home loan professional before proceeding which have people home exchange.

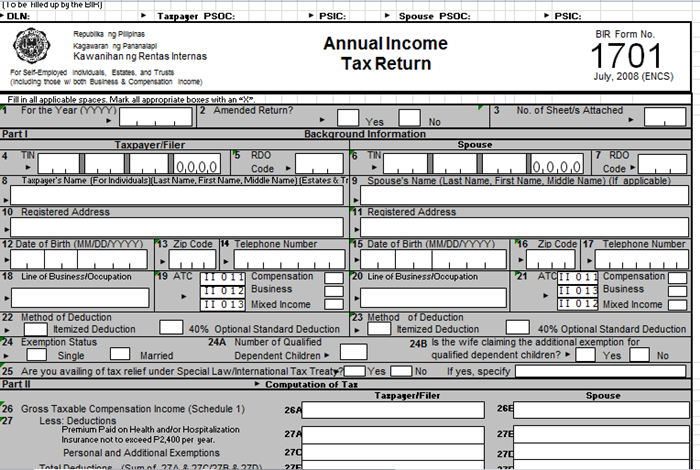

Can you Score a mortgage to own Belongings?

The brand new short response is yes. Unused lots and you can intense house was one another sort of assets you to can also be qualify for mortgages. Certain requirements discover accepted are generally unlike people getting providing home financing on a preexisting house.

Element of so it boils down to the possibility spends of property. Home that is residentially zoned and has now present tools and you will properties have downpayment conditions as little as 20%. Land in rural elements you to definitely lacks attributes instance electricity, h2o, and you will sewage, at the same time, is need a downpayment of up to fifty%.

Purchasing Vacant Property with no Money Off

Fundamentally, they range out-of difficult to impossible to rating home financing getting end up in Canada rather than a significant deposit. Simply because lenders want buyers having surface on the video game. Strengthening a house try an intensive, multistep processes. Loan providers want to know you will notice the process through.

Which have homes that will just be put recreationally, there isn’t the same partnership of individuals to get a house that would be the first family.

That being said, a number of channels causes it to be easy for people to acquire homes without having to go out of pouch to possess a down commission. Somebody who has a house have guarantee readily available that can be used to purchase the 2nd assets. You might borrow up to 80% of a home’s appraised well worth during the Canada. Because of this a home reviewed at $500,000 which have $two hundred,000 due on the mortgage can be used for a home collateral loan all the way to $240,000.

Unsecured unsecured loans are also possible for many borrowers. To help you qualify, individuals will demand each other a top credit history and you will an effective a job history with good money. The common limit for it type of financing is about $35,000, however, a debtor is also safer almost depending on individual factors.

Merchant resource could be an alternative in certain avenues. A purchaser could offer a supplier a reduced advance payment than the lending company in case your vendor is motivated and you will ready to performs using them. This will have a tendency to suggest increased interest rate compared to lender of the more exposure the vendor was and if.

Charge and requires for buying Unused Residential property

A down-payment into the a mortgage isn’t the merely money really buyers will purchase out-of-pocket when selecting unused homes and plenty, for example. A lender will generally speaking need an assessment ahead of giving financing. Charges for this particular service can range off $350 to $five-hundred or even more. Broker agents that assist assists sale usually normally fees a share since a fee. Expect to pay doing step 1% of the cost of the home. And most provinces provides homes import taxation that needs to be paid down during the time of get.

Browse brand new Residential property Mortgages Procedure

Knowing what you may anticipate and what is you’ll be able to will help customers availableness the fresh money they need. Look into the alternatives in your area and become happy to believe other money options to make your imagine to order a parcel possible. All that will be leftover try choosing a new house builder!

To possess educational purposes simply. Always consult an authorized mortgage otherwise mortgage elite in advance of proceeding which have one real estate exchange.