To invest in below-structure properties during the Asia even offers a range of you can easily debts positives and you will customization solutions when compared with buying able-to-move-in the belongings. However, that it requires lots of problems, as well as delays into the framework together with deviations off before revealed have. Understanding the home loan disbursement processes at under structure house is critical for home buyers. In lieu of money to possess completed properties, disbursements at under-design property are manufactured for the phase, considering framework advances, and you will individually paid on creator. That it phased fee strategy security the fresh new consumer’s funding and you will ensures that the fresh bank’s exposure is actually lined up on project’s conclusion degrees. Buyers have to be accustomed the construction-linked commission package, look after normal interaction to the financial to be sure timely disbursements, and you may screen the brand new project’s improvements to prevent interest on the undrawn quantity. Experience in quick installment loans for bad credit this course of action normally rather impact the monetary believed and you will complete experience of to shop for a significantly less than-design possessions during the Asia. This blog by the L&T Realty requires a close look at that process, providing you a better notion of ideas on how to begin to buy a lower than-construction house.

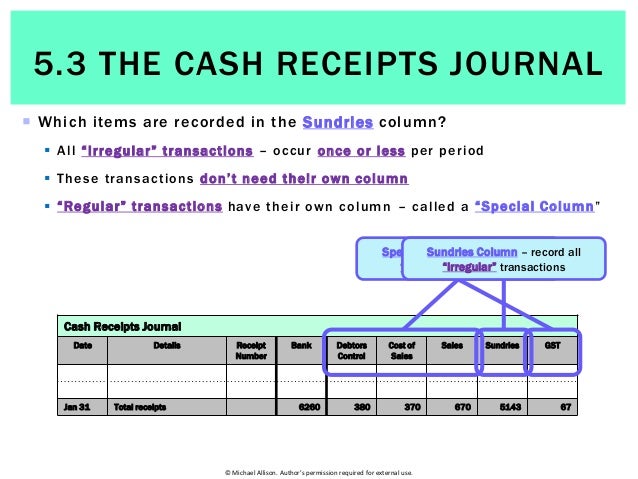

Information Financial Disbursement

The home mortgage disbursement processes involves the launch of mortgage numbers by financial into borrower, typically for the levels, according to research by the design advances of the house being ordered. This step boasts brand new submitting of your own application for the loan, verification of the home, the loan sanction techniques when you look at the banks, last but not least, the brand new disbursement in itself. The key organizations that are primarily doing work in this process is actually the fresh borrower, the financial institution (always a financial), additionally the property designer. As previously mentioned earlier, the new disbursement can either be complete or limited, with respect to the mortgage arrangement therefore the design phase of the property.

Mortgage Process and Housing Financing Disbursement Levels

Even as we possess talked about in the beginning of the weblog, mortgage disbursement at under-construction features is normally create inside the amounts, according to build progress, right to the fresh builder, making sure finance can be used for innovation. However, money for ready features was paid in one single lump sum for the provider upon mortgage approval and you can completion out-of judge conformity, highlighting the new quick import of ownership. You happen to be wanting to know what’s mortgage disbursement techniques for under-build land.

- Application Submitting: Complete your loan app and additionally expected data, together with name evidence, target proof, earnings data, and details of the home.

- Judge and you can Technical Verification: The lender conducts an appropriate evaluate of assets data files and you will an effective technical analysis of your build opportunity.

- Financing Contract: Shortly after approved, signal the loan arrangement, describing the loan terminology, disbursement plan, and you can rates of interest. The newest agreement plays a crucial role because legally attach one another people towards consented words.

- Disbursement Demand: Fill in a great disbursement demand setting in addition to the request page off the brand new creator, and therefore determine the current phase of framework in addition to count required.

- Disbursement: The lending company disburses the borrowed funds number within the installments in line with the construction amount, straight to the newest builder’s account, making sure the loan number is used to possess framework motives.

Financial Disbursement Amount

On home loan recognition, the financial institution products a sanction page describing the loan count, tenure, interest rate, and you will validity. New borrower have to upcoming submit a deposit receipt or other records including the allotment letter and you will burden certification for further processing. The financial institution assesses the house prior to disbursing the mortgage, in both complete or in installment payments, in line with the advances of one’s project’s construction and the financing get of the borrower. Observe that the past interest rate may vary regarding 1st give, into the lender issuing a revised approve letter properly.