For people who very own your residence, its likely that a beneficial you could potentially borrow cash on most glamorous cost. At PS Bank, the house Collateral solutions help you place your agreements on action to make lifestyle healthier plus friends.

Add a few room. Remodel the kitchen. Purchase something unique. Travel somewhere exciting. The lower cost and flexible cost preparations open a full world of opportunities.

- Lower fixed pricing

- Acquire around 85% of your own residence’s collateral (Collateral will be your house’s market value without the left equilibrium towards people mortgages)

- Take so you’re able to 2 decades to repay

- Zero settlement costs**

- Agenda simpler automated payments owing to On the internet or Cellular Financial

- Appeal money with the household collateral loans may be taxation-allowable.

*A lot more No Closure Rates Device Revelation: No settlement costs function PS Bank (Bank’) commonly waive origination payment, credit report commission, title look percentage, flood dedication payment, home loan recording percentage, lender attorneys fee, automated valuation payment, and you will financial taxation. One costs perhaps not especially indexed herein ‘s the responsibility of one’s debtor. Bank’s intention is to apply and you can pay for an automatic valuation of the collateral possessions. If an even more extensive appraisal are expected of the candidate otherwise is regarded as called for from the Lender for any reason, this new candidate is responsible for the purchase price recharged because of the appraiser. Possessions and you can possibilities insurance rates are expected and are usually the burden away from the fresh debtor. Flooding insurance coverage may be needed. For people who pay off and you may intimate the borrowed funds or range contained in this three-years of beginning, you must reimburse united states the 3rd-party charges paid in exposure to starting the borrowed funds otherwise line. Fees paid back so you’re able to third parties essentially overall anywhere between $ and you can $. Excite consult your tax advisor to determine if the focus was taxation allowable. A lot more fine print get use. Pricing subject to transform without warning. Relates to Pennsylvania qualities simply.

One simple software offers accessibility cash as often since you need they as well as for everything you like

Occasionally existence will get a small expensive. That is when it is sweet to have usage of more cash at the a good moment’s observe. With a property Security Line of credit, you could make a primary get, spend university fees debts, shelter medical costs – or maybe just make a move nice for you.

- Low introductory pricing

- Credit limitations to 85% of one’s residence’s equity (Security can be your residence’s market value minus the remaining equilibrium to your one mortgage loans)

- No closing costs*

*Even more No Closing Prices Product Disclosure: No settlement costs means PS Lender (Bank’) commonly waive origination fee, credit report fee, label search commission, ton determination commission, financial recording payment, bank attorneys fee, automatic valuation percentage, and you can home loan taxation. People costs not particularly detailed herein ‘s the duty of your own debtor. Bank’s purpose is by using and pay money for an automated valuation of collateral assets. In the event the a more thorough assessment is questioned by the applicant otherwise can be regarded as necessary of the Financial for any reason, the fresh new candidate would-be accountable for the price charged by the appraiser. Assets and risk insurance are essential and they are the responsibility out-of the brand new borrower. Ton insurance rates may be required. For people who pay back and you can romantic the loan otherwise line within this three years out-of starting, you must refund you the 3rd-group charge paid in experience of opening the mortgage or line. Costs reduced so you’re able to third parties essentially overall ranging from $ and $. Excite consult with your tax mentor to decide in the event that interest are taxation allowable. Even more conditions and terms can get use. Costs subject to alter with no warning. Relates to Pennsylvania functions just.

PS Bank are pleased giving a personal home collateral mortgage tool, Home Collateral 100%

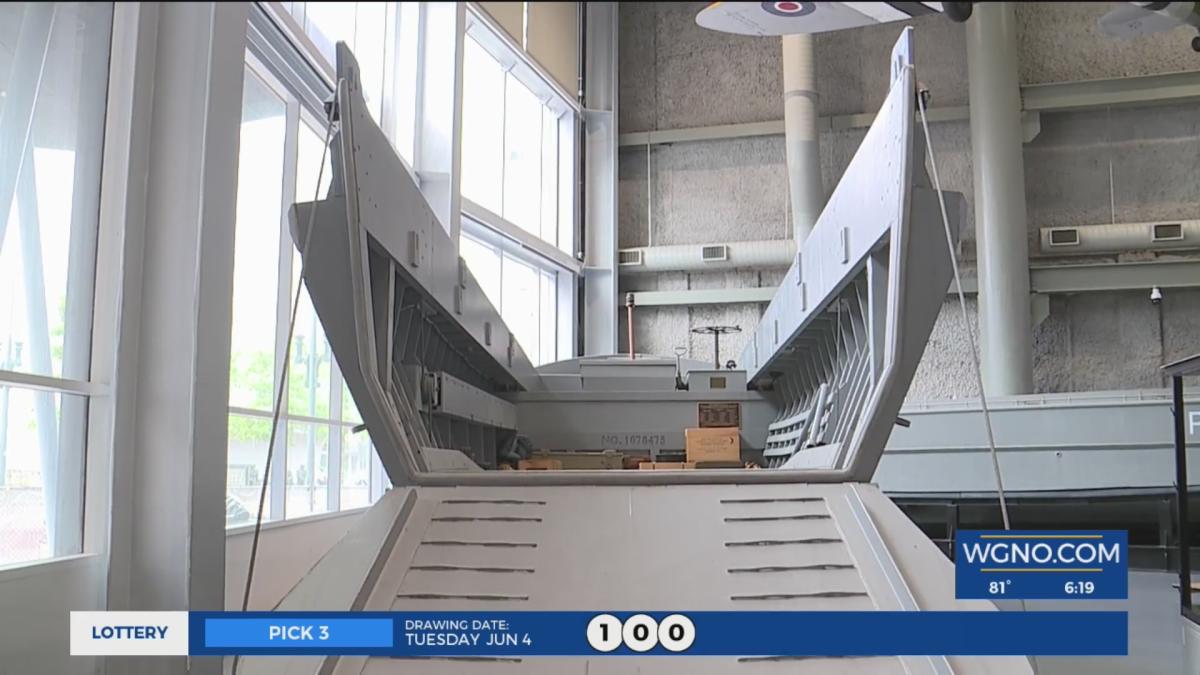

This product even offers our customers the capacity to acquire as much as 100% of worth of their residence to make its 2nd larger buy with no closing costs*. You might loans home improvements, purchase a secondary domestic, splurge for this Camper, otherwise have fun with towards the an alternative boat. Inquire all of us how to take advantage of Home Security 100%. Starting out is simple.

Small payday loan Lakeside amount of time Bring energetic at the time of . Prices may differ considering credit history, property/dwelling type, otherwise title regarding mortgage. Restriction loan to worthy of was one hundred%. Costs getting terms and conditions doing 240 weeks are available. Bring susceptible to borrowing recognition. Extra fine print may implement. Candidate accounts for third party fees on closing, anywhere between $ and $step 1,. Relates to Pennsylvania features and you will number 1 quarters just. Does not apply at were created home. Speak to your income tax coach to choose when the attention is actually tax-deductible. Assets and you can chances insurance policies are required and generally are the duty out-of the new borrower.