The income statement is full of arcane line items calculated on an accrual basis, and the balance sheet can be boiled down to a simple chart of accounts with no explanation of what caused the change in each account. When preparing the operating activities section of the statement of cash flows, increases in current liabilities are added to net income; decreases in current liabilities are deducted from net income. The current asset rule states that increases in current assets are deducted from net income. Thus $60,000 is deducted from net income in the operating activities section of the statement of cash flows.

Thus, it has already recognized the total $9,000 effect on cash (including the $2,000 gain) as resulting from an investing activity. Since the $2,000 gain is also included in calculating net income, Quick must deduct the gain in converting net income to cash flows from operating activities to avoid double-counting the gain. Investing and financing transactions are critical activities ofbusiness, and they often represent significant amounts of companyequity, either as sources or uses of cash. Common activities thatmust be reported as investing activities are purchases of land,equipment, stocks, and bonds, while financing activities normallyrelate to the company’s funding sources, namely, creditors andinvestors.

Impact of a decrease in Current Liabilities

The direct cash flow method includes all the inflows and outflows of cash from operating activities. Rather than accrual accounting, it uses cash basis accounting, which recognizes revenues when cash is received and expenses when they’re paid, providing a real-time look at cash inflows and outflows. The direct method then tallies these payments and expenses similarly to the indirect method to determine a business’s net cash flow. Quick shows the $9,000 inflow from the sale of the equipment on its statement of cash flows as a cash inflow from investing activities.

These financing activities could include transactionssuch as borrowing or repaying notes payable, issuing or retiringbonds payable, or issuing stock or reacquiring treasury stock, toname a few instances. Toreconcile net income to cash flow from operating activities, thesenoncash items must be added back, because no cash was expendedrelating to that expense. Investing and financing transactions are critical activities of business, and they often represent significant amounts of company equity, either as sources or uses of cash. Common activities that must be reported as investing activities are purchases of land, equipment, stocks, and bonds, while financing activities normally relate to the company’s funding sources, namely, creditors and investors. These financing activities could include transactions such as borrowing or repaying notes payable, issuing or retiring bonds payable, or issuing stock or reacquiring treasury stock, to name a few instances. To reconcile net income to cash flow from operating activities, these noncash items must be added back, because no cash was expended relating to that expense.

What is the Statement of Cash Flows Indirect Method?

For instance, the net cash flows from operating activities is the same for both methods, and the investing and financing activities are identical for both methods as well. The statement of cash flows above for Wellbourn Services Ltd. is an example of a statement using the direct method. Note that the operating section line items using the direct method are based on the nature of the cash flows, whereas the indirect method line items are based on their connections with the income statement and working capital accounts. (Figure)Use a spreadsheet and the following financial information from Mineola Company’s financial statements to build a template that automatically calculates the net operating cash flow. It should be suitable for use in preparing the operating section of the statement of cash flows (indirect method) for the year 2018.

- Assets represent resources owned by the business, providing future economic benefits, while liabilities encompass the company’s debts and obligations to external parties (including its owners).

- The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements.

- Specifics about each of these three transactions are provided inthe following sections.

- As you can see, the operating section always lists net income first followed by the adjustments for expenses, gains, losses, asset accounts, and liability accounts respectively.

- You start with revenue and subtract out all expenses to discover what is left.

- In both cases, these increases in current liabilities signify cash collections that exceed net income from related activities.

As you can see from this dialogue, the statement of cash flows is not only a reporting requirement for most companies, it is also a useful tool for analytical and planning purposes. Next, we will discuss how to use cash flow information to assess performance and help in planning for the future. Phantom’s most recent balance sheet, income statement, and other important information for 2012 are presented in the following.

Differences between the direct and indirect methods

Net book value is the asset’s original cost, less any related accumulated depreciation. Propensity Company sold land, which was carried on the balance sheet at a net book value of $10,000, cash flow statement format indirect method representing the original purchase price of the land, in exchange for a cash payment of $14,800. The data set explained these net book value and cash proceeds facts for Propensity Company.

- Now let’s work through each current asset and current liability line item shown in the balance sheet (Figure 12.3) and use these rules to determine how each item fits into the operating activities section as an adjustment to net income.

- Let’s take a look at the format and how to prepare an indirect method cash flow statement.

- This year your company decided to sell the land and instead buy a building, resulting in the following transactions.

- In general terms, the indirect method is a way to calculate cash flow using transactions to determine payments and expenses rather than cash on hand.

- Since the $2,000 gain is also included in calculating net income, Quick must deduct the gain in converting net income to cash flows from operating activities to avoid double-counting the gain.

- A short term notes payable from a bank would be treated as a financing activity and not an operating activity.

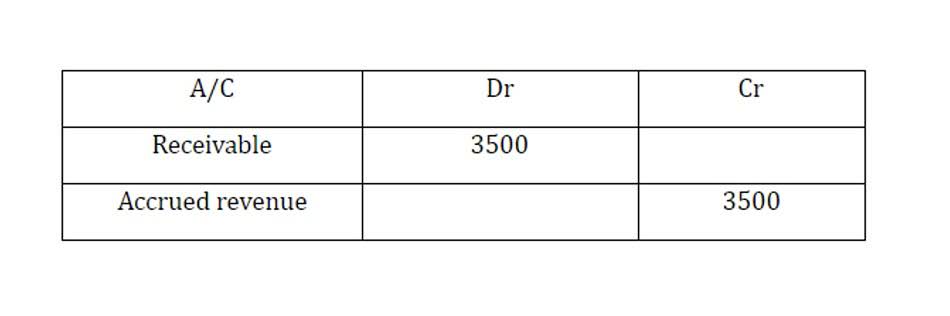

In this example, no cash had been received but $500 in revenue had been recognized. The offset was sitting in the accounts receivable line item on the balance sheet. There would need to be a reduction from net income on the cash flow statement in the amount of the $500 increase to accounts receivable due to this sale. Under the indirect method, the cash flows statement will present net income on the first line.